How Not To Get Robbed By Your Most Trusted Employee

“We just found out that our highly trusted employee, who has been with us forever and we’ve helped so many times has been embezzling from us!”

I hear that story a lot.

I also hear this one: “I can’t figure it out, it’s been a record-breaking year but we are broke!”

There are lots of stories. Stories of organizations not in control of their finances.

Not Controlling Your Finances Means You Are Out of Control

Organizations that don’t have a good grip on their finances struggle to grow. A lack of adequate (not even great) financial management and controls is of the top three reasons why small businesses are unable to:

- Grow from seven to eight or more figures

- Survive tough times (like COVID/recessions/etc.)

- Sell

- For non-profits, this means everyone stays underpaid and overworked and you never gain ground on your vision.

As organizations grow, managing “by instinct” gets too complicated. Loss and slippage start to overtake profitability.

It’s not only small businesses. You might remember Enron and WorldCom. Multi-billion-dollar companies – that “lost” billions. Theoretically overseen by boards stuffed with some of the brightest financial minds in the country. Except they weren’t watching.

So, they lost control.

What Are Financial Controls?

Financial controls are structures, tools, policies, and practices that:

- Create transparency into an organization’s financial situation

- Guide allocations and financial decisions.

- Provide information for analysis and management.

- Define the processes for how money moves and is tracked into, within, and out of the organization.

Most companies don’t develop good financial controls. This is usually because the process seems confusing and overwhelming.

But it’s not that bad. Really.

Six Categories of Controls

There are six categories of controls[i] that organizations should use. When practiced well, they improve organizational performance. Instead of feeling like a bureaucracy, they create freedom.

They are:

- Culture

- Communication

- Segregation of Duties

- Record Keeping

- Budgets

- Reporting

An Overview of The Six Categories

Culture: This is the cheapest and easiest approach. Culture is shaped by the behavior of an organization’s leadership. Their behavior is a demonstration of their values and priorities. When leaders:

- Borrow company equipment

- Ask, “We talked about business didn’t we?” when the dinner check comes.

- Leave passwords on sticky notes on their computer monitors

- Keep the petty cash in an unlocked drawer that is opened in front of visitors.

It communicates to others that exceptions can be the rule. Grey areas are worth exploring. Lax security is fine. If you can get away with it – maybe you should.

Little eyes are watching. Model the example you want others to follow.

Communication: The best way to communicate what is expected is to record it. Whether this is a three-ring binder, a file on a shared drive, or a company app – it needs to be accessible.

For most organizations, this feels overwhelming. In actuality, it isn’t that complicated. The solution is found in this old saying: “How do you eat an elephant? One bite at a time.”

The simplest approach to follow the procedure below:

Simple Process Writing Method™:

- Create a list: Sit down (individually or with a team). Set a timer for 15 minutes. Create a list of all the financial policies and procedures that you are aware of. Don’t describe them. Just name them. It doesn’t have to be exhaustive.

- What is easiest? From that list – underline the simplest or easiest ones to describe.

- What is most important? Also from that list, circle the most important or critical ones to write/record.

- Delegate and do: Everyone picks one of the items to work on. Begin with one that is easy and (ideally) important. Set a deadline. Get it done.

- Meet and approve: At the deadline, meet, compare notes, edit and approve.

- Communicate: Make this accessible to those who need it. A shared computer file. A 3-ring binder.

- Rinse, repeat.

*This Simple Process Writing Method™ is an example of how simple this can be. And yes, I trademarked it.

Work through this once or twice and most people discover that it is neither overwhelming nor time-consuming.

Segregation of Duties: Thomas McLaughlin says, “Embezzlement is a loner’s crime.” Don’t leave someone alone with the money or in complete control of the money.

Separate financial duties. Examples:

- Ensure your bookkeeper and your accountant are different people.

- Unless you regularly undergo an independent audit – don’t use a bookkeeper who is employed by your accountant.

- Have a separate tax accountant from your day-to-day accountant.

- Separate who mails checks for invoices from the person who writes and signs the checks.

- Ensure payroll is approved by someone with knowledge of the staff, their salaries, and performance expectations.

- Separate who reconciles bank statements from who completes deposit slips.

- Require multiple signatures on checks above a fixed amount.

This takes a team.

Small businesses can afford a team. This isn’t the place to be cheap.

My business is very small. I’m the only employee. I have a financial team of three: Myself, my CPA, and a bookkeeper. Both contract to me. Our roles are separate. Everyone but me is a trained and qualified financial professional. Their cost is far outweighed by their benefit.

For small organizations, your team can be as simple as mine. As companies grow to around $3 million in revenue – they should expect to have at least one or two full-time equivalents working on accounting. They may be internal or external.

Somewhere between $10 million and $20 million you want to start thinking about a controller, if not a CFO.

Start out with pros. Don’t hire spouses, the kid who is good with computers, or your friend’s self-taught bookkeeper. Once you have them – separate their roles.

Record keeping: Keep records of all money (and assets) that moves into, within, and out of your organization.

This can be as simple as:

- Tracking money that comes in: Cash register tape/POS records/cash journals/service journals

- Tracking money that goes out: Payroll/petty cash/accounts payable

- Recording both into your general ledger

Some companies do track what comes in and goes out. But they get behind on recording this into their general ledger.

This is nearly the same thing as not doing anything.

It is nearly always cheaper, in the long run, to hire or contract a qualified bookkeeper.

There are many savings from good records: You can control costs. You can reduce fees due to late payables. You can ensure timely billing and receivables. Your taxes may cost less to complete because you aren’t asking a CPA to do a bookkeeper’s work.

Budgets: Having a basic budget is also a simple financial control tool. There are many benefits to good budgeting within organizations. A budget combined with accurate record-keeping and timely budget performance reports helps you see and address when receipts or expenses are different than anticipated.

Reporting: Your bookkeeper should be able to produce regular, accurate financial reports for you. For small organizations, monthly reporting (completed within seven to ten days of the end of the month) is often enough.

The basic reports you should receive are:

- Balance sheet: A point-in-time of record of the money/assets you have and money/liabilities you owe.

- Profit and loss: A summary of revenues, costs, and expenses over a period of time (often monthly, quarterly and annual).

- Budget performance: A comparison between your budget and actual performance.

- Aged accounts receivable: Money owed to you but is taking longer than expected to collect.

Also valuable:

- Cash flow projections: An estimate of the money expected to come in and go out over a period of time.

- Utilization rates: A comparison of the expected vs. actual performance of each of your income-generating assets. These “assets” include billable staff and equipment, rentable facilities, etc.

Organizations that cannot produce reports cannot manage their finances. They struggle to get financing when needed, they are usually unable to sell.

What To Do If Your Help Isn’t Helping

If your current financial approach or team doesn’t have, isn’t building financial controls and improving your ability to financially manage the organization – something needs to change.

For small organizations (under $5M to $10M depending on the industry), I refer to personally-screened fractional CFOs. If you are larger, you might start bringing that level of skill on board as one of your first professional role hires.

You should expect to see significant results within three to six months. If your pros are taking longer than that, they probably don’t know what they are doing or aren’t set up for this kind of work.

Look for someone who is able to help you or your financial team to set up the controls I describe. They should also be willing to take the time to teach you how to benefit from them.

I usually prefer experienced firms over individuals. This is for two reasons: A) Someone who has built a firm has usually put in place controls themselves and “gets it”. B) A firm usually means they have staffing redundancy – so you don’t have to worry when someone leaves.

The only exception I make to this is when an individual is operating entirely on an advisory level. Like a tax advisor or financial planner.

Take good care,

Christian

P.S. If you need a referral to a financial pro who will come through for you – let me know.

[i] I borrowed and slightly adapted this framework from the book “Streetsmart Financial Basics for Non-Profit Managers” (Second Edition) by Thomas McLaughlin. Non-profit organizations often have higher reporting/accountability requirements than businesses but fewer resources to meet those requirements. A framework that works for them will work for your business.

There are 𝟭𝟮 𝗰𝗿𝗶𝘁𝗶𝗰𝗮𝗹 𝗾𝘂𝗲𝘀𝘁𝗶𝗼𝗻𝘀 to ask before accepting a new CEO position. Do you know what they are? Instantly download my free e-book here.

𝗧𝗵𝗲 𝗕𝗲𝘀𝘁 𝗧𝗶𝗺𝗲 𝘁𝗼 𝗖𝗿𝗲𝗮𝘁𝗲 𝗔𝗻 𝗘𝗺𝗲𝗿𝗴𝗲𝗻𝗰𝘆 𝗦𝘂𝗰𝗰𝗲𝘀𝘀𝗶𝗼𝗻 𝗣𝗹𝗮𝗻 𝗶𝘀 𝘽𝙚𝙛𝙤𝙧𝙚 𝗬𝗼𝘂 𝗡𝗲𝗲𝗱 𝗜𝘁.

Be prepared for a smooth transition in the event of an unplanned emergency succession. My guide will show you step-by-step how to devise your own plan.

Are you interested in learning more about becoming a successful CEO? If so, get a free copy of my book The Successful New CEO. Not a new CEO? I’ve been told by “old hands” that they felt any CEO should read this. So, click here to get your copy today.

by “old hands” that they felt any CEO should read this. So, click here to get your copy today.

Let’s connect.

I’m passionate about helping leaders to create workplaces they love going to and increasing the value of the services they offer. My results-oriented approach is tailored to each client’s specific situation and needs. As a leadership coach, I have developed a wealth of resources to help you and your team grow and become stronger.

Weekly Newsletter – sign up to receive my weekly articles addressing critical leadership challenges and issues.

The Leadership Coach Podcast – In my podcast, we explore effective, high-impact, and enjoyable leadership. Subscribe.

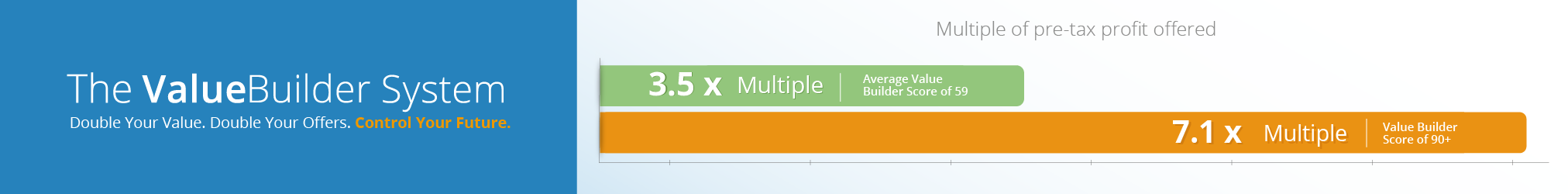

Find the value of your company with my free assessment tool: The Value Builder System

The Value Builder System™ is a 13-minute online questionnaire that evaluates your business on the eight factors that contribute more to its attractiveness and value. These factors are scored on a scale of 1-100. Businesses that score over 80 are likely to command 70%-100% higher value than others.

Opportunities

Executive and Leadership Coaching: Do you feel overwhelmed? Are you not getting the results you expect from the effort you are putting in? Do you find yourself facing similar challenges time and time again? Would you like to change specific ways of relating or reacting? If you would like to experience predictable, measurable growth Contact me.

Profitable Exit Strategy Workshop: Are you a business owner or partner? Over 55? Starting to think about exiting your business or active management in the next 3-5 years?

- Curious about what your business might be worth?

- Would you like to discover the specific steps you need to take to increase its value and become highly attractive to a buyer?

- Are you planning on handing it over to family or employees and you want to ensure long-term success?

If so, contact me now

Article Categories

Popular articles

Download my free 10-page eBook:

How To Accomplish More Without Doing More:

Eight Proven Strategies To Change Your Life

Discover how to save eight hours during your workweek-even if you're too busy to even think about it. The resource every maxed out executive needs.